Algorand

All analyses, articles and other information on this website are presented for informational purposes only. None of the content should be interpreted as professional financial advice, investment recommendations or invitations to buy or sell securities. We are not registered as financial advisors under Swedish legislation, and our content therefore does not fall under the rules for financial advice to consumers.

Investment decisions should be based on careful analysis and professional advice from qualified financial experts. We strongly recommend that you consult an independent financial advisor before making important investment decisions. Remember that all investments involve risks - your capital can both grow and decrease in value, and there is no guarantee that you will get back your original investments. Past results say nothing about future returns.

By using this website you accept that we cannot be held responsible for any economic losses or damages that may arise based on the information here.

On this page we recommend some products and services that we like ourselves. It could be books, magazines or online banks (IG, Avanza or Nordnet for example). Sometimes when we recommend something we get a commission and that's how we make money to have resources to keep the site running.

We think it's very important to stand behind what we recommend so the site only contains links to companies and services that we think are really good.

Table of Contents

Algorand is a blockchain, with associated cryptocurrency (ALGO), which with scalability, decentralization and security wants to create opportunities for “the finance of the future”.

The blockchain can be somewhat simplified compared to an operating system where then lots of programs can be applied and services created. In terms of user function, there are some similarities with Ethereum and Binance Smart Chain. A big difference, however, is, for example, scalability. While Ethereum has had to fight with sky-high gas prices, it is something that has never occurred with ALGO.

The total value of Algorand in August 2021 was $ 3,485,179,184 and the currency was number 44 in terms of market cap among cryptocurrencies.

The purpose of Algorand is to be a platform adapted for, above all, smart contracts in finance. The focus is on the “economy of the future” with blockchain-based financial services for both individuals, institutions and states.

Investing in Algorand means positioning yourself in a blockchain that is relatively new – which can successfully attract developers of dApps, smart contracts and games. It can of course be seen as a higher risk than the already established blockchains with similar functions such as Ethereum, Polkadot, EOS and Cardano. Of course, there are differences in technology and function between these chains.

What is Algorand?

Algorand is a blockchain developed to meet the problems that the earliest blockchains have struggled with, such as to find the balance between security, scalability and decentralization. This takes place in Algorand primarily via Pure Proof of Work, which increases decentralization and safety in relation to classic Proof of Work. (Read more about the technology below)

Despite being a relatively new blockchain (launched in 2019), Algorand has received a great deal of attention and quickly became one of the 50 largest cryptocurrencies in terms of market cap.

FutureFi

Algorand presents the blockchain as “FutureFi”, ie. Future Finance. Blockchain technology enables a more decentralized and accessible financial structure. The chain is developed to meet the needs of both institutional investors, decentralized finance and countries’ needs for digital currency. This via for example:

(Examples of applications available on Algorand)

“Algorand builds technology that accelerates the convergence between decentralized and traditional finance by enabling the simple creation of next generation financial products, protocols and exchange of value.” / Algorand.com

Pure proof of stake

A unique feature is Pure proof of stake. An inclusive, environmentally friendly and efficient function which means that scalability and security do not have to pay for decentralization. Basically, Proof of Stake is used, but instead of a few people joining, everyone who keeps ALGO in their wallet can contribute to the process and the maintenance of the network. This is achieved, among other things, by two different types of nodes and two different types of smart contracts.

Two nodes

Participants Nodes produce the blocks on the block chain. First, 1000 nodes are drawn to participate in the process. It is then one of these 1000 that gets to create the block and add it to the block chain. As with all proof of stakes, there is a benefit to having a larger amount locked (staking) because the chance of being selected depends on the amount that is locked.

This also means that the block chain is inclusive as everyone who holds ALGO can be involved in creating future blocks. This is in contrast to several other cryptocurrencies with Proof of Stake where only wallets with amounts above a certain level are involved in creating blocks.

To participate in this process, it is required that ALGO is kept in their official wallet and that settings are stated that this wallet must contribute with Proof of Stake.

Instead of only a single wallet receiving the entire mining reward, it is instead distributed to everyone who is part of the network. This is based on the amount of ALGO in the wallet in relation to the total amount of ALGO in circulation.

With this technical solution, Algorand focuses on the three important points that characterize cryptocurrencies – but which few have managed to find a sufficiently good balance between.

Security – Because 1000 wallets are “drawn” from everyone who holds ALGO, hackers can never know in advance who will produce the blocks. Compare this to the classic Proof of Stake where the number of miners is significantly fewer and sometimes even partially public.

Decentralization – Everyone can participate and contribute to the network. All that is required is 1 ALGO. No special mining equipment is required either, a wallet via a computer or mobile is sufficient.

Scalability – This consensus technology creates the opportunity for fast and very cheap transactions. The cost of an average transaction is $ 0.001. Several similar cryptocurrencies have significantly higher transaction costs, not least Ethereum until Ethereum 2.0 is fully implemented.

System of two layers block chain

A key to security and scalability is that Algorand is made up of smart contracts in two layers. In the first stock (ASC1) there are “simple” contracts such as transactions, swaps and loan contracts. In the second layer, there are more complicated contracts such as those that need access to external information. These are handled “off-chain” and when they are completed, the information is transferred to the first layer.

In addition, Algorand offers “Co-chains”, which are private blockchains. They can, for example, be used by companies or organizations that want to take advantage of the blockchain’s technical advantage in a simple way without developing their own chain. The unique thing is that the chain is only reached by those who have gained access to it. The users of this chain can also interact with other Co-chains and other chains to, for example, send and access information. A co-chain can be compared to a private network.

(Algorand: What is ALGO´s future potential? – Coin Bureau)

CBDC

Can Algorand become the blockchain for CBDC?

Several countries around the world have begun research, and in some cases development, of their own digital currency based on blockchain technology. These are not decentralized as cryptocurrencies and are expected to be handled by central banks.

CBDC = Central Bank Digital Currency

Advanced blockchain solutions are required and several companies have shown interest in offering their services to develop suitable solutions. The Marshall Islands chose Algorand as the blockchain for their national digital currency – can more countries follow?

(Alogrand – Where is ALGO headed? – Coin Bureau)

The future

Since 2019, when the blockchain was launched, Algorand has created collaborations with a number of companies and organizations. Collaborations that show the potential of the blockchain and that companies see opportunities in the security and transparency that is created. Example:

Invest in Algorand

Investment in Algorand can take place via several different platforms and crypto exchanges. What mainly distinguishes them is user-friendliness and how the currency is handled.

Coinbase

Coinbase is known for being extremely user-friendly and is especially recommended for new people in crypto. Via the app, or the website, trading can take place against fiat and swaps can be carried out (switching between two coins).

The downside is that Coinbase charges a higher fee than many other cryptocurrencies. A price that is still offset by very great user-friendliness.

From Coinbase, ALGO can then be sent to a wallet to, for example, be part of the mining process for additional returns.

Binance

The world’s largest crypto exchange, Binance, offers trading in hundreds of cryptocurrencies. In addition, investments can be made in options, other leverage products and a number of different savings services. The advantage is the extremely large range of currencies, products and services. The disadvantage is that Binance can be difficult to navigate for a beginner. (See also our review of Binance)

eToro

eToro.com/sv offers both trading in CFDs and real cryptocurrencies. When investing in Algorand, this is done directly in the real asset.

The advantage of eToro is the user-friendliness. Money can be deposited via card, PayPal and bank transfer and the platform is in Swedish. Each individual purchase is also kept separate, which makes it easy to see any profit / loss per trade. In addition, there is the opportunity to buy “funds” that consist of several different cryptocurrencies.

The disadvantage is that trading takes place within eToro and it is difficult to export these coins to a wallet outside the platform.

Value development of Algorand

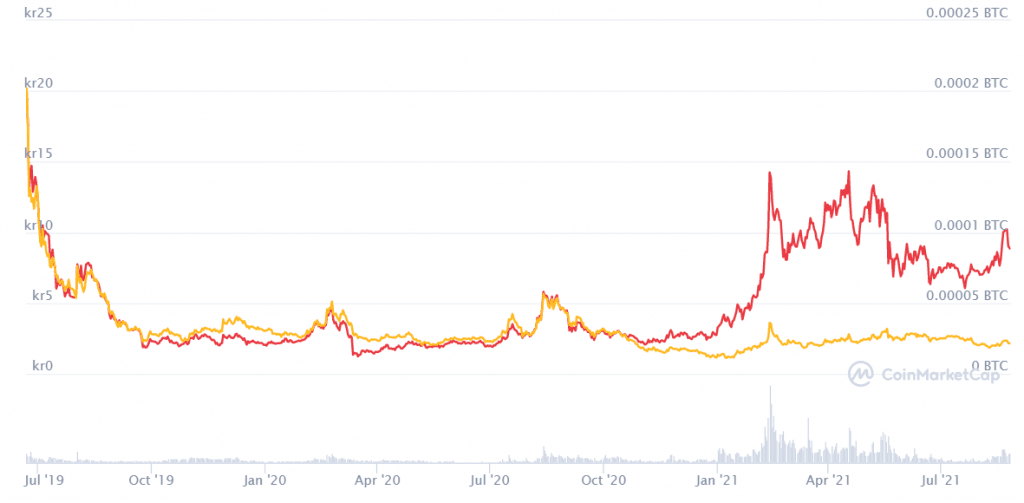

Like other crypto projects, Algorand is funded through an ICO. It was implemented in 2018 and 2019 and then raised over 500 million dollars. The value development was negative to say the least in the beginning. Just two months after the blockchain was launched, the price plummeted. This was partly based on the fact that private investors had bought at a lower price than what ALGO was sold for during its ICO and a buy-back program had to be staged.

At the same time, this was for a couple of months when the entire crypto market fell sharply. It can be seen in the graph below where Bitcoin (yellow) is set against the development in Algorand (red).

If a currency appears to “fall free”, its value development should always be set in relation to the value development of Bitcoin. If Bitcoin falls in value, most of the crypto market will be included in the case.

In July 2020, the price rose rapidly, which was considered to be due to the “Coinbase effect”. It became official that trading would be offered on Coinbase, which directly meant that more people had the opportunity to invest. On the other hand, it would turn out to be a short-term increase in value.

During the first half of 2021, the value development was more positive. The following news during the first months of the year may have contributed to the development.

Ethereum fees are skyrocketing – But traders have alternative

At the beginning of the year, a simple transaction on Ethereum could cost over $ 80. It became “impossible” to use the blockchain for smaller transactions. For example, traders quickly began to look for other and cheaper alternatives.

Stablecoin adoption and pivot to DeFi drive Algorand price higher

The Marshall Islands chose Algorand as the blockchain for their national digital currency. Can more states follow in the same footsteps as interest in stack coins and digital currencies has increased?

Algorand price strengthens as institutional investors back the project

The fact that large institutions invest in a blockchain usually means both media attention and a stamp of credibility that can mean that more people dare to invest and use the blockchain.

(Headlines are from Cointelegraph)

Algorand in the future?

To understand how Algorand can work in the future, the video below is recommended. It is an interview with W.Sean Ford (COO of Algorand) where he explains the advantages of this blockchain against similar technical solutions. Basic knowledge of blockchains and cryptocurrencies is a recommendation to fully understand the interview.

No comments yet