CFD Trading & Comparison of CFD Brokers

All analyses, articles and other information on this website are presented for informational purposes only. None of the content should be interpreted as professional financial advice, investment recommendations or invitations to buy or sell securities. We are not registered as financial advisors under Swedish legislation, and our content therefore does not fall under the rules for financial advice to consumers.

Investment decisions should be based on careful analysis and professional advice from qualified financial experts. We strongly recommend that you consult an independent financial advisor before making important investment decisions. Remember that all investments involve risks - your capital can both grow and decrease in value, and there is no guarantee that you will get back your original investments. Past results say nothing about future returns.

By using this website you accept that we cannot be held responsible for any economic losses or damages that may arise based on the information here.

On this page we recommend some products and services that we like ourselves. It could be books, magazines or online banks (IG, Avanza or Nordnet for example). Sometimes when we recommend something we get a commission and that's how we make money to have resources to keep the site running.

We think it's very important to stand behind what we recommend so the site only contains links to companies and services that we think are really good.

Table of Contents

CFD (Contract For Difference) is a derivative instrument that makes it easy to take a long or short position in underlying assets such as commodities, stocks, indices, cryptocurrencies & currencies. You do not own the underlying asset directly when you buy a CFD, you instead own an instrument that follows / tracks the price of the underlying asset.

Long position = you make money if the price goes up

Short position = you make money by lowering the price (clear the position)

Buy CFD:s = take a long position

Sell CFD:s = take a short position (clear the position)

Sell CFD:s that you already own = clear the position

Buy CFD:s that you have previously sold / cleared = clear the position

Compare CFD brokers

IG

- Minimum deposit: 0 $

- Offers CFD-trading in:

Forex, Cryptocurrencies , Stocks, Options, Indexes, Commodities. - Free platform for technical analysis and trading.

Summary of IG

IG is one of the most widely used CFD brokers. IG is large and offers basically everything you could want at very low prices and spreads. You can use their trading platform for free for technical analysis and to follow all the world’s markets in real time 24/7.

- Minimum deposit: 50 $

- Offers CFD-trading in: Forex, Cryptocurrencies, Stocks, Indexes, Commodities. They also offer regular trading with direct ownership in both stocks and cryptocurrencies.

- Offers copy trading.

- Stocks are traded completely without commission.

Disclaimer: eToro offers, among other things, CFD trading. 78 % of private individuals who trade via Etoro lose money when they trade with CFDs. You should consider if you understand how CFDs work and if you can afford to take the high risk of losing your money.

Summary of eToro

eToro is a large and international CFD broker that offers copy trading where you can automatically copy all trades that successful traders take. They also offer regular stock trading completely without brokerage.

CMC markets

- Minimum deposit: 1 $

- Offers CFD trading in: Forex, Cryptocurrencies, Stocks, Indices, Commodities.

Summary of CMC

CMC is a CFD broker that is used a lot in Sweden due to the fact that their website and platform have been translated into Swedish. The big advantage of CMC is that they have no minimum deposit requirements. So you can deposit only $ 1 if you wish.

How CFD trading works

When you take a position in a CFD, you bet that the value of, for example, a stock, a commodity or currency will increase or decrease. The stock, commodity or currency is then called the underlying asset.

If you press buy, you bet that the price of the underlying asset will go up. If you instead press sell, you bet that the underlying asset will go down (you can simply say that you are short).

This is one of the great benefits of CFDs. You can easily invest in decline. You simply click on sell and choose how big a position you want to take.

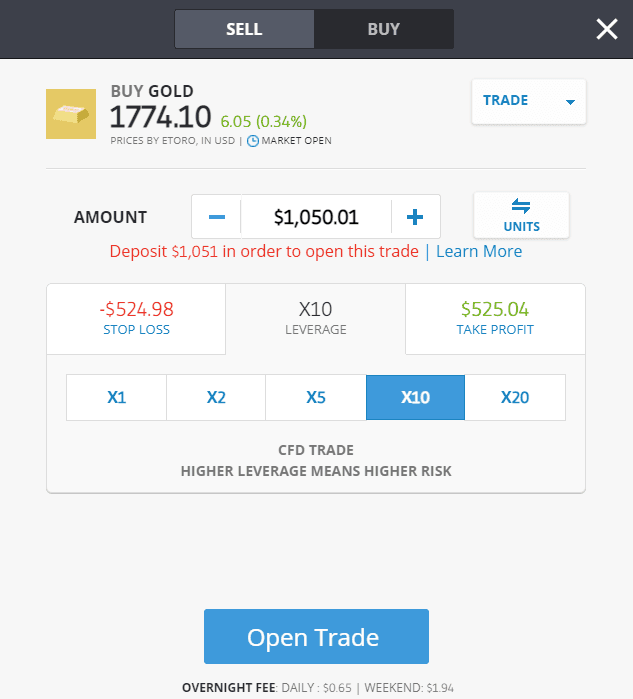

The image above shows eToro’s trading platform for CFDs. In this example we show how to take a position in gold. It follows the price of gold. If the gold goes up in price, the value of your position rises and vice versa.

“This is one of the great benefits of CFDs. You bet on decline in the same way you bet on rise. You simply click on buy or sell and choose how big a position you want to take.”

Safety requirements & leverage

CFDs have a built-in leverage. It is based on a so-called safety requirement. A security requirement is a requirement that you have at least a certain amount of cash in your account in order for you to take a certain position. Let’s say you want to take a position in gold as in the picture above. In order for you to take a position of about 1400 USD in gold, it is required that you have about 70 USD in your account.

This gives you a solid leverage. You only bet 70 USD but your position in gold is 1400 USD. The security requirement here is then 5%. The leverage will then be 20 times (20x) when the safety requirement is 5%. You must therefore have 5% of the size of your position in cash.

If your position goes down, the loss will be deducted from your $ 70. Because the position is so large thanks to the leverage, very small movements are needed for your 70 USD to double or go down to 0 USD in value. To protect yourself against this, you must make sure to keep the size of your positions down and have substantial margins on the safety requirement. For this position, it might be reasonable to instead have about 700 USD in cash / security in their account to be on the safe side. Then you have reduced your leverage from 20 times down to 2X. If $ 700 is too much for you to bet, you can take a smaller position instead.

If you take too large positions, your safety requirement will be quickly deleted and your position will be closed automatically with a loss.

For example, if you have only $ 70 in your account, then perhaps you should not take positions larger than a maximum of $ 140 or similar to be on the safe side.

Example:

Alphabet incs stock is traded for 100 USD. You estimate that Alphabet will rise and then buy 10 CFDs with Alphabet as the underlying asset at the level of 100 USD. Your total position / exposure is then 1000 USD in Alphabet.

You have deposited $ 100 in total into your CFD account.If the security requirement is 5 percent (%), $ 50 will be deducted from your account as a security requirement.

If Alphabet rises to $ 105 and you decide to close your position and sell for $ 105, you have earned $ 5 x $ 10 = $ 50 on your deal excluding any brokerage. This means that you have made a 50% profit on the capital you deposited in your CFD account.

If Alphabet instead drops to 90 USD and you decide to close your position and sell for 90 USD, you have lost 10 USD per CFD and you did buy 10 pcs. So you have lost a total of 100 USD. The loss is equal to the amount you deposited in your CFD account and it means that you have lost 100% of the money you deposited in the account..

To the cfd brokers’ websites:

– Go to IG.com

– Go to etoro.com – 78 % of all private individuals who trade CFDs at eToro lose money.

Examples of IG’s collateral requirements for various CFDs

Indexes 5 – 10 %

Currencies 3,3 – 5 %

Stocks 20 %

Cryptocurrencies 50 %

Commodities 5 – 10 %

Questions and answers

Answer: Yes, in some cases you can.

Answer: Yes, you can set regular stop-losses in the platform and you can also set a guaranteed stop-loss. It is ALWAYS triggered, even if the underlying asset makes a gap. A guaranteed stop-loss is much safer. An ordinary stop-loss risks not being triggered by, for example, gaps in the underlying asset.

Why should you trade in a CFD?

One can really ask oneself why one wants to trade with an instrument that follows the value of the underlying asset instead of the asset directly?

The ease of taking a position and the possibility of leverage that you can regulate yourself are the biggest advantages of CFDs.

Via CFDs, you can access almost all assets, indices, etc. in the simplest possible way and there is always the opportunity to buy and sell. It is also a very simple way to go short (clear) an underlying asset. Taking a short position in CFDs is by far the easiest way to invest in a decline in an underlying asset.

One reason to trade CFDs is that it is one of all financial tools where you can trade with leverage. This means that even with a little less money, you can borrow in a way that enables larger profits. The downside of this is that the risk of losing money is also higher. But of course this also creates an opportunity to make more money than you can do with “regular” stock trading.

With the leverage also comes the advantage that you tie up less capital in each position. If you invest in ordinary stocks for USD 100,000, this money will be tied up in the stocks. If you trade with leverage, you have, for example, the opportunity to deposit a security (the so-called security requirement) of 10%, that means 10,000 USD, and still be able to trade for the remaining 90,000 USD in other positions. Again, of course, this also involves a risk. You have the opportunity to decide for yourself how big your security requirement should be and therefore your leverage.

When you trade with ordinary stocks, it is primarily on rises and dividends that you make money. When you trade with an instrument like this, your ability to make money increases because you can also make money on declines.

Risks to think about

One thing you should always keep in mind is that you do not take too many risks when trading in CFDs. You can lose more money in this trade than you own, so it is important to make a careful analysis of your risks. Always make sure you keep a close eye on the tool you use so that you do not exceed a limit of what you can handle.

A rule of thumb is to always have at least 50% of the size of your position in cash in your account so you reduce the rule of being automatically thrown out of your position.

No comments yet