EOS

All analyses, articles and other information on this website are presented for informational purposes only. None of the content should be interpreted as professional financial advice, investment recommendations or invitations to buy or sell securities. We are not registered as financial advisors under Swedish legislation, and our content therefore does not fall under the rules for financial advice to consumers.

Investment decisions should be based on careful analysis and professional advice from qualified financial experts. We strongly recommend that you consult an independent financial advisor before making important investment decisions. Remember that all investments involve risks - your capital can both grow and decrease in value, and there is no guarantee that you will get back your original investments. Past results say nothing about future returns.

By using this website you accept that we cannot be held responsible for any economic losses or damages that may arise based on the information here.

On this page we recommend some products and services that we like ourselves. It could be books, magazines or online banks (IG, Avanza or Nordnet for example). Sometimes when we recommend something we get a commission and that's how we make money to have resources to keep the site running.

We think it's very important to stand behind what we recommend so the site only contains links to companies and services that we think are really good.

Table of Contents

EOS can be likened to an “operating system” on a blockchain. A system that should be easy and free to use for programmers and users.

The cryptocurrency used on the network is called EOS. The more EOS a person owns, the greater part of the network can be used. The value is mainly affected by the number of users who want to take advantage of the services available on the network.

The total value of EOS in November 2020 was $ 2,273,395,549 and the currency was then the thirteenth largest cryptocurrency. Similar currencies include Ethereum, Ada and Cardano.

The purpose of EOS is to offer a decentralized network that is easy to use for programmers as well as those who use the services created. On the blockchain, for example, apps, smart contracts, and games can be created. It can be compared to the blockchain’s response to the Android system for mobile phones.

Investing in EOS means that more and more services will be built on this blockchain and that the number of users of these services will increase. In order to be able to program or use the network, the user must hold EOS. The more EOS that is held, the larger part of the network can be used.

What is EOS?

EOS is both a cryptocurrency and the name of the decentralized network (blockchain) on which this currency is used.

Functionally, EOS has similarities with Ethereum, such as to be a network for future applications on the blockchain. Sometimes the network has been called “The Ethereum Killer” but it has turned out to be a complement and not a competitor.

Very simply, EOS can be compared to an operating system on a phone (Android). On this system, people can create their own apps, games, currencies and smart contracts. This is similar to the function of the apps on the mobile.

What characterizes EOS, in relation to other similar crypto projects is:

• EOS shall not have any transaction costs. Instead, a person is required to hold a certain number of EOS in order to complete transactions. It can be compared to Gas which needs to be paid for transactions on Ethereum.

• EOS is expected to handle millions of transactions second. However, they have not had to scale up the network to that speed yet. Bitcoin can handle 7 transactions per second.

• EOS has 21 “witnesses” who create the blocks. These are voted on by everyone who holds EOS. Those who hold EOS can also vote on proposals for changes to the blockchain.

• Holding EOS provides access to the network. The more that is held (stake), the greater part of the capacity can be utilized.

• Want to be the leading blockchain for dApps. With a simple programming language, it should be easy to program and create – and use what is created.

Stake – To lock a certain amount of currency on the blockchain against a certain reward.

EOS has a built-in inflation of 5%. This is because the witnesses who create the blocks receive 1% each year in relation to how many blocks they have created. The rest goes to a development fund and can be given to someone who comes up with a good idea for the development of EOS. (Similar layout to Dash)

(Technical explanation of EOS benefits.)

Why is EOS needed?

Why is a decentralized operating system needed for apps, contracts and financial services? To understand the strength of EOS (and similar currencies), it is important to understand how a blockchain works and what benefits come with it. (Read more about Bitcoin and blockchains) In short, it is about creating freedom and democratic conditions. But also about streamlining and security of digital asset management.

A small example:

A person today creates an app and wants to charge for certain services in it. Then Apple needs to approve the app for it to enter the AppStore and Google charges a certain fee for the payment solution to interact with Android. Two large companies that control virtually the entire market. The same problem applies to financial services. With EOS, it is possible to create apps and contracts without the influence of the state, company or authority. It is the “people’s” operating system.

Dpof (Deligation Proof of Stake)

EOS has placed a strong focus on scalability, a common problem in cryptocurrencies. Bitcoin, for example, can handle 7 transactions per second, while the goal with EOS is to be able to handle over one million.

The reason why it is so long in Bitcoin is that a consensus is required between the nodes before a transaction is allowed through and approved. EOS has abandoned this by using 21 “witnesses” who are block producers instead. The system is called Dpof – Deligation Proof of Stake.

Anyone who holds the EOS can constantly vote on who will have the right to produce the next block. Twenty of the blocs are produced by the most votes. In addition, a block is produced by someone who is “drawn” among those who have received votes. In this way it is ensured that it is not always exactly the same that creates the blocks.

At the same time, there is a requirement that those who create the blocks are really active and create blocks for the block chain. Should someone not do this in 24 hours, they will be removed from the list that users can vote on.

Instead of lots of computers adding computer power and competing for rewards (Bitcoin), the trust is given by the users to a select few. Instead of Proof of Work, Deligation Proof of Stake is used.

It is through this structure that greater efficiency on the blockchain can be created, which is the reason why more transactions can take place per second.

EOS in three minutes

Criticism – Too centralized?

Understanding Dpof is important for understanding EOS. This is based on the fact that the criticism made of the blockchain is often about it being “too little decentralized”. It is enough for someone to take over 11 of these witnesses to have control over the blockchain. It can be compared to Ethereum and Bitcoin where thousands (or millions) of computers need to be taken over at exactly the same time.

The fact that EOS is developed, and improved by, a private company is also considered to be a sign of a certain centralization.

(Educational English film that explains the technology behind EOS)

EOS or Ethereum?

There are similarities between EOS and Ethereum in terms of functionality for users. But at the same time there are very big differences both in terms of the technical structure and the user-friendliness. The differences are briefly mentioned here.

EOS – The more tokens you own, the more part of the network you can use. This creates a “bottleneck” to be able to use the network to a greater extent. A person must have EOS – to be able to use EOS. At the same time, the transactions are free for those who hold EOS. New blocks are created by the 21 witnesses who are voted on by all EOS owners.

ETH – The network can be used by anyone and a Gas fee is paid to complete a transaction. Although Ethereum is required to be able to use the network (to be able to pay Gas), the cost is the same regardless of the size of the transaction or which service is used. New blocks are created by a large network of nodes that anyone can connect to. With Etheruem 2.0 also comes Proof of Stake.

(Swedish crypto expert Ivan on Tech explains, in English, the difference between Ethereum and EOS)

Invest in EOS

There are primarily two ways to invest in EOS. One option is to buy the cryptocurrency and keep it in a cryptocurrency wallet or on a cryptocurrency exchange. The second option is to buy certificates that follow the EOS value.

Buy Certificate – (Example Etoro)

Via Etoro it is possible to invest in CFD (Contract for Difference) which follows the development of EOS. After registration at the trading venue, the identity is verified by uploading an ID document. After that, money can be deposited via, for example, cards, bank transfer and PayPal.

• Certificate that follows EOS value

• Trade with leverage (create large position without large capital)

• Easy to take buy or sell position

Buy the cryptocurrency – (For example Etoro, Coinbase and Binance)

As EOS is one of the major cryptocurrencies, the currency can be purchased from almost all major cryptocurrencies. This such as Etoro.com, Kraken, Coinbase.com and Binance.com. By owning these coins, access is given to the network and the services accessed there. Owning a real EOS thus has the greatest advantage in the currency can be used for its purpose.

• Can be transferred to wallets, networks, services

• Can be exchanged for hundreds of other cryptocurrencies

Value development in EOS

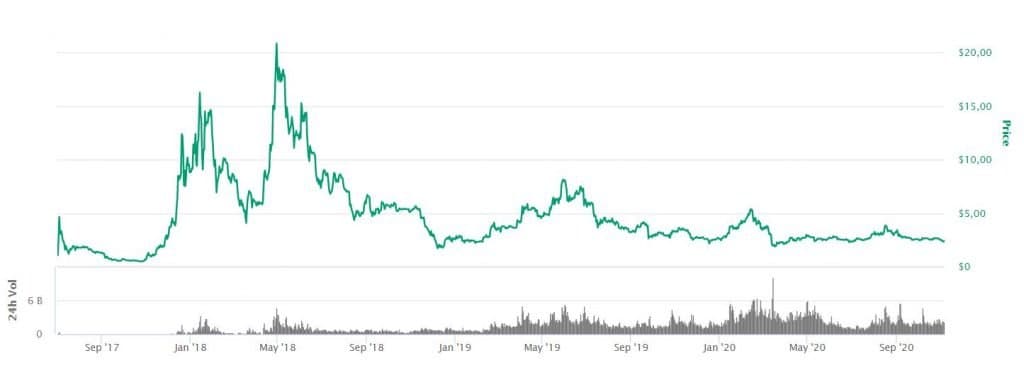

The blockchain is developed by the private company Block.one. The company created an ICO in 2017 and then received over 4 billion USD! This is both because many believed in the project and because they launched their ICO during the so-called ICO boom. Before the bull run at the end of 2017, the EOS was 1-2 USD..

Unlike many other coins, however, EOS does not have its ATH in 2017 or January 2018 (just before the powerful cryptocurrency crash). Instead, the currency has its peak in May 2018 with an ATH of 22.71 USD.

In January 2019, the bottom level was reached for many of the major cryptocurrencies and since then, the value development has gone up for most. EOS, on the other hand, has had ups and downs since then and has declined a few percent.

They can be compared to Bitcoin, which has risen by about 400% over the same period. Over the past two years, several of the ten largest cryptocurrencies have developed significantly better than EOS. Not increasing in value over two years may indicate that the growth of users on the platform is not at all in line with what is expected. At the same time, the EOS, like all currencies, is still evolving.

What determines the price of EOS?

Only supply and demand for EOS control its price. Demand is increasing if many want to take advantage of the services available on the blockchain. This is because you must own EOS to be able to use the blockchain. Indirectly, the price is thus also affected by the development of “competing” blockchains with similar concepts. In addition, the price may be affected by national laws and regulations regarding cryptocurrencies.

No comments yet