CAGR calculator

All analyses, articles and other information on this website are presented for informational purposes only. None of the content should be interpreted as professional financial advice, investment recommendations or invitations to buy or sell securities. We are not registered as financial advisors under Swedish legislation, and our content therefore does not fall under the rules for financial advice to consumers.

Investment decisions should be based on careful analysis and professional advice from qualified financial experts. We strongly recommend that you consult an independent financial advisor before making important investment decisions. Remember that all investments involve risks - your capital can both grow and decrease in value, and there is no guarantee that you will get back your original investments. Past results say nothing about future returns.

By using this website you accept that we cannot be held responsible for any economic losses or damages that may arise based on the information here.

On this page we recommend some products and services that we like ourselves. It could be books, magazines or online banks (IG, Avanza or Nordnet for example). Sometimes when we recommend something we get a commission and that's how we make money to have resources to keep the site running.

We think it's very important to stand behind what we recommend so the site only contains links to companies and services that we think are really good.

The average annual growth or return is mostly what is being used when calculating how much an investment has grown per year in percentages. This type of calculation is called Compound Annual Growth Rate, or CAGR for short.

CAGR Calculator

Calculate annualized growth between two values.

Detailed information

Total return:

10,000 kr

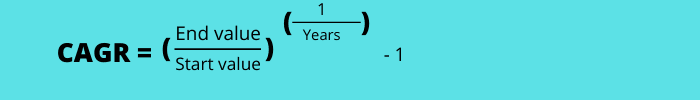

CAGR = (Ending / Starting)^(1/years) − 1.

Value development over time

Visualization using compound growth at calculated CAGR

Example:

Let’s say you start with USD 100 that you invest in either shares or funds. 10 years later the total sum of your investment is USD 800.

On average, how much has your money increased per year?

Answer: 23.11 %

The money has, in other words, grown by 800 % in 10 years. You may ask: Why shouldn’t the yearly growth be at 80 %? The answer is the interest-on-interest effect. Interest-on-interest means that you not only generate interest on your savings – you also generate interest on the interest that was made previous years.

On the other hand, if you would calculate with a 80 % interest for 10 years, your start amount at USD 100 would reach USD 35,705 by year 10. A significant difference, to put it mildly.

If you would like to use this way of calculating, i.e. with the interest-on-interest effect, you can use our compounding calculator here at Investacle.

How do you calculate compound annual growth rate?

The formula for CAGR is relatively complex, which you can see in the picture. In order to correctly calculate CAGR you follow these steps:

- Divide the end sum with the start sum.

- Take the result from step 1 and take it to the power of 1 divided by amount of years.

- Take the result from step 2 and minus 1.

CAGR is sometimes referred to as equalized rate of return. This is because CAGR measures the yearly growth rate of the investment with the assumption that the rate is constant

If you do not have an end sum to calculate with, but you do know the growth rate (percentage) of your investment, you can calculate the end sum with this calculator. The value you end up with you can then use in the CAGR-calculator above.

What can I benefit from CAGR and interest on interest?

It is a clear advantage to understand interest on interest and CAGR if you want to understand the nature of investment growth. If you, for example, have invested money that has increased by 100% in 12 years, it may sound good. But when you calculate CAGR you will see that it really isn’t that impressive. If you instead hear someone say that they have increased the value of their portfolio by 20% every year for 10 years, you understand what an extreme development that is, even though 20% at face value might not seem like a lot.

How quickly invested capital can be doubled

If we assume 10% return, your investment will double (increase by 100%) after 7,3 years. The chart below shows how quickly your investment doubles based on the yearly growth rate

| Annual return % | Number of years for capital to double |

| 1 | 69,7 |

| 2 | 35 |

| 3 | 23,5 |

| 4 | 17,7 |

| 5 | 14,2 |

| 6 | 11,9 |

| 7 | 10,3 |

| 8 | 9 |

| 9 | 8 |

| 10 | 7,3 |

| 11 | 6,6 |

| 12 | 6,1 |

| 13 | 5,7 |

| 14 | 5,3 |

| 15 | 5 |

No comments yet